The CTN is a comprehensive investor experience model that integrates components of behavioral finance with Aaron Beck’s Cognitive Therapy via clinical psychology. This is a work in progress on this blog and you can read more about it here.

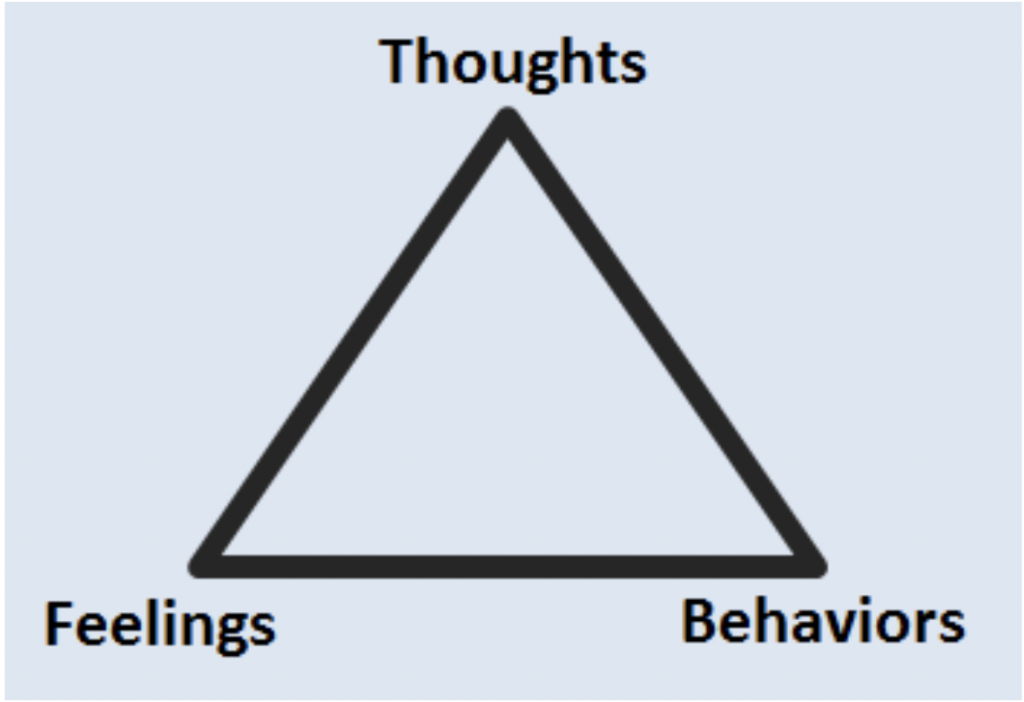

The Cognitive Triangle is a critical structural component of Beck’s clinical model. It includes three modes of experience – thoughts, feelings, and behaviors, one at each point of the triangle. Here is a simple visual representation:

You can think about this structure geometrically. If you change any angle of a triangle, the other two angles also change as well as the lengths of the sides.

If you change the way you think, your feelings and behaviors will shift and so forth.

You can think of the sides of the triangles as the relationships between these modes of experience. One side equates to the relationship between thoughts and feelings, one side to the relationship between feelings and behavior, and one side to thoughts and behaviors.

So, the three modes are represented, the relationships between them are represented and changes to any angle or side are represented.

All people have tendencies in the way they think, behave, and feel and in the way these three modes interact with each other. Ingrained pattern tendencies are personality. You can think of the environment as a circle around the triangle and brain chemistry as residing inside the triangle.

Like similar triangles, similar patterns can be identified across groups of people who share similar personalities. Among those with specific mental disorders, triangle profiles can help identify appropriate diagnoses and guide treatment.

For example, one type of depressive may have a profile with dominant experiences that looks something like this:

- Thoughts: I’m a loser and unlovable

- Feelings: Sadness, Fear of rejection

- Behaviors: Stays in, Avoids relationships

Of course, this is simplified but you get the gist.

Clinical diagnosis is complex and there are multiple profiles within individual mental disorders. Categorical diagnostic models are incredibly valuable but imperfect.

Individual diagnoses do not fit perfectly, cookie cutter style, into established prototypes across disorders. People are all different. Nevertheless, these patterns are consistent after controlling for these individual differences, uncanny, and significantly predictive from a treatment perspective.

Over 40 plus years, Beck’s model has been applied to many types of mental disorders. Treatments derived from these diagnostic formulations have been tested, refined, and validated across thousands of studies, a wide variety of disorders, and across multiple researchers. Cognitive Therapy stands as one of the most robust diagnostic and treatment models in the history of clinical psychology.

Cognitive Triangle and Behavioral Finance

The Cognitive Triangle can seamlessly be applied to investor experience phenomena described in the behavioral finance literature. The purpose of this application parallels the purpose of the source applications via Beck and his successors. They include but are not limited to:

- We can get better understand how experiential patterns manifest across modes and how they interrelate.

- We can build off robust research methodologies that have been refined over years of development and review in order to test and calibrate investor experience phenomena.

- We can develop evidence based treatments.

- We can adapt the rich, global personality theory underlying Cognitive Therapy in the assimilation of investor behavior phenomena, which would mark a huge advance for behavioral finance.

Disposition Effect within the Domain of Losses Prototype

So let’s take a quick look at how we might formulate the disposition effect within the domain of losses. The disposition effect, you might recall, is an extension of prospect theory, first put forth by Shefrin and Statman, which describes how people tend to behave irrationally when they are losing money on an investment or making money on an investment. You can read more about it here and here.

Within the domain of losses, investors have a tendency to increase risk seeking behaviors like holding losers, increasing position size etc. This is the market manifestion of loss aversion. Interestingly, Shefrin and Statman nicknamed this “Get-Even-Itis” – essentially pathologizing the experience in a good-humored way. They should have been reading Beck! 😉

So let’s have a first look – what would a Cognitive Triangle profile look like for the irrational money loser, a case of Get-Even-Itis.

- Thoughts – “Losing money will be devastating.” “Losing money will make me a loser.” Cognitive avoidance.

- Feelings – Aversions relating to loss realization, regret, anxiety, and shame

- Behaviors – Riding the loser. Increasing risk, Avoidance (ex. not looking at a statement)

This is a simplified profile. In the next post, I will focus in detail on the disposition effect within the domain of losses including the full profile, treatment implications, and research recommendations.